Wiki-Amazon FBA

Q & A about shipping to Amazon

Q1: Pallet requirements I intend to get the goods palletized on wooden pallets and am trying to work this out with the factory. They prefer to use plastic pallets; however, these are not accepted by Amazon. Do you have any suggestions on the palletizing side?

Answer:Yes. Amazon accepts only wood pallets or plywood pallets. Wooden pallets must be fumigated and must adhere to IPCC regulations.General requirements and dimensions

Use standard or EUR-pallets for stuffingUse GMA Grade B or higher, 40" x 48" / 1 m x 1.25m 4-way access, wood pallets

Any single pallet must not be taller than 72"

Pallets can be double stacked for a max height of 100"

Max weight per pallet: 1,500 lbs. / 680.4 kgQ2: Palletizing place Should we palletize cargo at origin or at destination for FCL & LCL shipments?

Answer:

FCL shipments

For FCL shipments, palletizing at origin is recommended if the manufacturer can provide qualified pallets. Luckylucky can build pallets at destination (US, CA, UK, DE, AU) as per Amazon's requirement.

LTL shipments

For LTL shipments, palletizing at origin is recommended for fragile cargo. Otherwise, cargo can be delivered in cartons to the consolidator's warehouse, and they will be palletized at destination before delivery to Amazon.

Palletizing may be done at the destination or during shipping, depending on various factors. Based on past experience, if the goods are not fragile, we would recommend palletizing at the destination. This eliminates the

need to factor in the weight and volume of the pallet itself when calculating freight costs. Palletizing at the destination also ensures that the pallet complies with the requirements of the importing country and Amazon.

As airport and destination deconsolidation warehouses typically follow standard procedures, there may be instances where the goods need to be repalletized to meet Amazon's specific requirements.

Q3: Product and packing requirements for goods deliver to Amazon FBA

Amazon's products need to be affixed with the barcode of the product, so that the inventory can be scanned when it is put on the shelf.

*Sellers can choose the barcode generated by Amazon, or buy a third-party barcode to upload to Amazon.

*U.S. Customs requires the country of origin on the product packaging. Some Amazon sellers will print the country of origin information on the barcode.

*If the product has a plastic bag and the opening is larger than 5 inches, the customer needs to be reminded to put a suffocation warning (to prevent the child from suffocating on the head)

*If the product is a set, a set of products must be packaged or wrapped together for easy differentiation

* If the product box itself is not fragile, we recommend the customer to ask exporter to do a drop test.

* At least 5-layer corrugated export carton should be used in the carton* For other special packaging such as fragile products/plush products, please refer to Amazon's packaging guidelines document

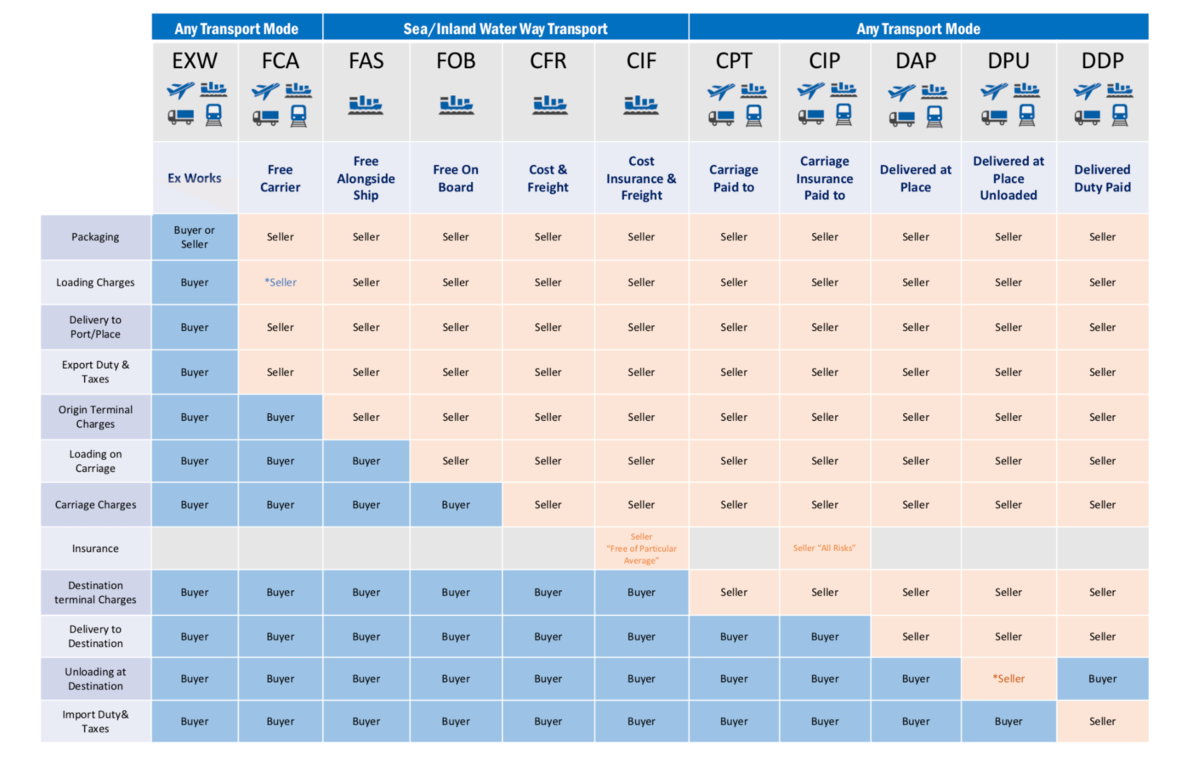

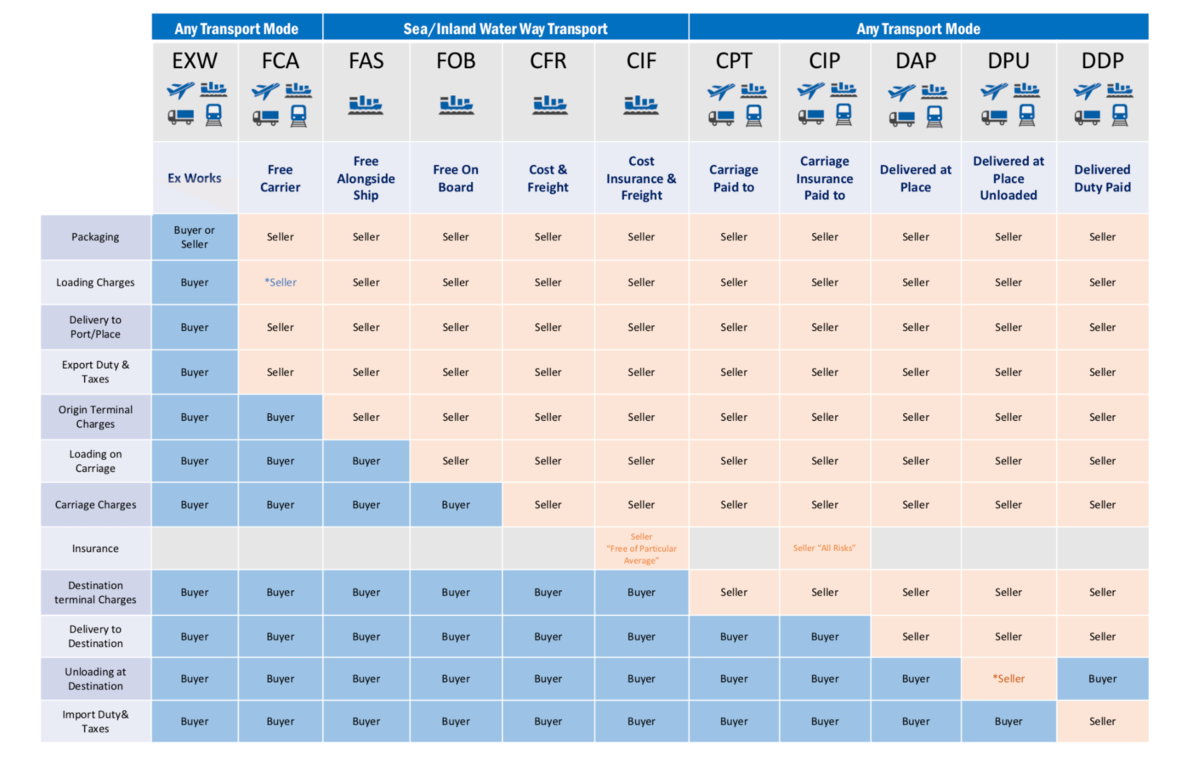

https://sellercentral.amazon.com/help/hub/reference/G200141500Q4: Frequently-used Incoterms and comparison (FOB, CIF, EXW, DDP)

Answer:

An Incoterm, short for "International Commercial Terms," is a set of standardized international trade terms used in contracts for the sale of goods. These terms define the responsibilities, risks, and costs associated with the delivery and transportation of goods from the seller (exporter) to the buyer (importer).

We recommend that you request separate quotations from the exporter for both FOB and EXW prices. Additionally, please consider the door-to-door service fees provided by us and choose the option with the lowest total cost. It is essential to pay particular attention to situations where the exporter suggests using CIF/CFR terms with the exporter arranging transportation.

You should ensure that the destination port charges are reasonable, that there are no hidden fees, that the transportation plan complies with regulations, and that the promised transportation timeframes are guaranteed."

EXW (Ex Works):

Exporter's Responsibility:

Make the goods available for pickup at their premises or another named place (e.g., factory or warehouse) .

The exporter must package and prepare the goods for transportation.

The exporter is not responsible for any transportation, loading onto a carrier, or export-related costs beyond making the goods available.

Importer's Responsibility:

The importer assumes full responsibility and liability from the point of pickup in China.

They are responsible for arranging and paying for all transportation, including inland transportation within China, ocean or air freight to the destination, and any associated charges.

The importer must handle customs clearance, pay import duties and taxes, and cover all other costs associated with importing the goods.

My purchase is EXW. Who should do the clearance? I have not ever done this.

Answer: If your purchase is Ex Works (EXW), the responsibility for clearance typically falls on the buyer. The supplier's responsibility is limited to preparing the goods for pick-up by the carrier at the factory, and the supplier is not obligated to provide export customs clearance documents or paying any export local charge.

FOB (Free On Board):

Exporter's Responsibility:

Under FOB, the exporter's responsibility extends to delivering the goods to the named port of shipment.

This includes costs related to loading the goods onto the vessel (or aircraft, in the case of FOB Airport).

All costs associated with the departure port, except for freight charges, are the responsibility of the exporter.

The exporter is required to prepare the necessary export documents and cooperate in providing import

customs clearance declaration documents. Booking of cargo space must be initiated by the exporter with

the forwarder, and the bill of lading will be issued to the exporter.

Importer's Responsibility:

The importer assumes responsibility for all costs and risks once the goods are on board the vessel at the named port of shipment in China.

This includes ocean freight charges, marine insurance, unloading the goods at the US port, customs clearance, and inland transportation within the US.

Essentially, the importer is responsible for the entire shipping process from the point the goods are on board the vessel in China.

"FOB + LOADING PORT" indicates that the responsibilities and costs before the

goods cross the ship's rail at the Loading Port are borne by the seller. Therefore,

the seller is obligated to transport the goods to the specified port and cover all

export local charges incurred before the goods are loaded onto the vessel.

CFR (Cost and Freight):

Exporter's Responsibility:

The exporter is responsible for delivering the goods to the named port of destination, covering the costs of transportation to that port, and arranging for the loading of goods onto the vessel.

The exporter is also responsible for obtaining and paying for the freight charges up to the destination port.Exporter's responsibility ends when the goods are on board the vessel.

Importer's Responsibility:

The importer assumes responsibility for all costs and risks from the point the goods are on board the vessel at the named port of destination.

This includes unloading at the destination port, customs clearance, and inland transportation.

DAP (Delivered at Place):

Exporter's Responsibility:

The exporter is responsible for delivering the goods to the named place of destination (not just the port), including transportation and associated costs.

The exporter arranges for import customs clearance and pays for import duties and taxes (if applicable).Importer's Responsibility:

The importer assumes responsibility for receiving the goods at the named place of destination.

The importer is responsible for unloading the goods, which may include transportation from the named place to their premises.

DDP (Delivered Duty Paid):

Exporter's Responsibility:

The exporter is responsible for delivering the goods to the importer's premises or another named location in the destination country.

The exporter covers all transportation costs, including customs clearance, import duties, and taxes in the destination country.Importer's Responsibility:

The importer is primarily responsible for receiving the goods at the named location.

The importer may need to provide access to their premises for delivery.

In summary, the key differences between these Incoterms are the extent of the exporter's responsibility and the point at which the importer assumes responsibility. Under CFR, the exporter is responsible up to the destination port. Under DAP, the exporter takes responsibility for transportation to a specific place but not unloading. Under DDP, the exporter handles all aspects of the delivery, including unloading and customs clearance, making it the most comprehensive option for the importer but often with a higher cost. The choice of Incoterm depends on the parties' agreement and the specific requirements of the transaction.

Q5: We are looking for an accurate and quality quotation.

To get an accurate and quality quotation for door-to-door freight, please provide the following information in your inquiry:

1. Commodity name, material, HS code (we can also check with your supplier for more details in order to calculate import duty cost).

2. Weight, measurement, number of cartons, packing

3. Delivery address (Amazon warehouse or importer's warehouse at destination)

4. Manufacturer's address (pickup cost)

5. Trade terms (FOB, EXW, DAP, DDU)

6. Registered importer in US/Europe or not? (Do you have EIN/EORI/VAT?)Q6: Do I need to have an inspection?

For best results, we highly recommend using an inspection service, especially for Amazon shipments. This service helps to ensure the quality, quantity, and packing of the product, which can impact product reviews. In e-commerce businesses, products are shipped directly from the manufacturer to the consumer, so there is no importer/distributor/wholesaler's inspection. Any defects in product, packing, or labeling must be identified before delivery to consumers to avoid high return logistics costs. Inspection services offer random sampling and overall inspection, with the cost of random sampling inspection listed in Q6. Please contact us for a case-by-case confirmation of overall inspection costs based on actual product quantity.

Q7: How is the inspection service charged and what is the procedure?

The standard inspection cost is USD 155.00 per person per day, and the inspector will check the quantity, visible workmanship, function inspection, labeling and marking, packing, barcode and QR code, etc.

Please provide us with the manufacturer's address, contact information, the person in charge, and the inspection checklist at least 2-3 days prior to the intended inspection date. The inspector will randomly inspect 50-300pcs of products based on the client's inspection checklist. After the inspection, we will send you an inspection report and videos the next day. Please note that the inspection cost may vary if the factory is located in a remote area. A successful inspection requires the manufacturer's full cooperation.Q8: What is the difference between air freight and courier express? What is chargeable weight?

Air freight is cheaper than courier-express, but courier-express includes customs declaration and delivery. For door-to-door delivery, courier-express is often more competitive if chargeable weight is less than 200 kg. Chargeable weight for air freight is cargo's cbm x 167, while for courier-express it is cbm x 200. Delivery to Amazon for courier-express doesn't need appointment, but has a volume limit. For air-freight (LTL) shipment, an appointment is needed for Amazon delivery, but there is no quantity limit.

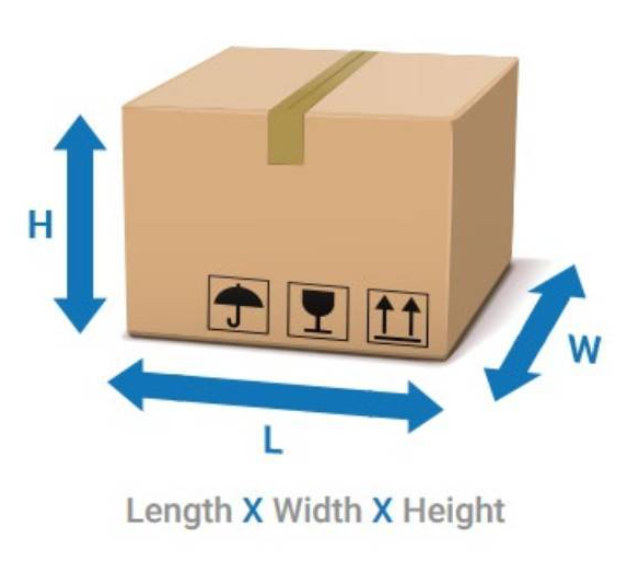

What's chargeable weight?

Chargeable weight is the weight used to determine the shipping cost of a shipment, calculated as the greater of either the actual weight or the volumetric weight of the shipment. The calculation method of chargeable weight can differ for different transportation methods, such as air freight and sea freight.

Express/Groupon sea freight(CN-SG, CN-AU)

Measurement (cbm) * 200 compared with gross weight(kg), whichever is larger

For example, for 1 CBM of cargo with a gross weight of 100 kg, the volume weight is is 200 kg, as the volume weight is bigger, the chargeable weight is 200kg.

For another example, if 1 CBM cargo has a gross weight of 300 kg, the volume weight is 100 kg, as the gross weight is bigger, the chargeable weight is 300kg

Air freight

Measurement (cbm) * 167 compared with gross weight(kg), whichever is larger

For example, for 1 CBM of cargo with a gross weight of 100 kg, the volume weight is is 167 kg, as the volume weight is bigger, the chargeable weight is 167kg.

For another example, if 1 CBM cargo has a gross weight of 300 kg, the volume weight is 167 kg, as the gross weight is bigger, the chargeable weight is 300kg

Q9: How long does it take to ship to Amazon by Ocean/Air/Courier Express?

China-US West Coast

Ocean FCL: 18-23 days

Ocean LCL: 20-25 days

Air freight: 4-7days

Courier Express: 3-8 days

China-US East Coast

Ocean FCL: 33-38 days

Ocean LCL: 35-42 days

Air freight: 4-7 days

Courier Express: 3-8 days

China- Europe

Ocean FCL: 33-38 days

Ocean LCL: 35-42 days

Air freight: 4-7 days

Courier Express: 3-8 daysHow long does it usually take to load the goods from the moment you are getting it? How long is the door-to-door process?

The loading time varies, and the door-to-door process depends on

factors such as stock lead time, shipping method, loading/discharge port

efficiency, and customs clearance. We can provide an estimated timeline once

specific details are provided.

Q10: Do you offer insurance for the shipment? What is covered by the insurance?

Yes, we help our clients get insurance coverage and we recommend that they do so. Because of our large volume of shipments, we have competitive insurance costs and can provide easy electronic issuance of the insurance policy. Cargo insurance (ALL RISKS) protects the client against potential loss and damage of goods.

If Amazon and the consignee report any damage or loss of goods, please obtain all related evidence and forward it to us as soon as possible. We will coordinate with the insurance company and claim compensation.Insurance Premium Billing Method: Insure at 110% of the declared value of the goods, with an insurance premium rate of 0.3%. Long-term cooperative clients and high-value goods are eligible to apply for discounted insurance premium rates through our customer service.

Q11: When should I request that you liaise with the factory in regard to the freight?

You can have your supplier contact us one week before the goods are ready, or you can provide us with your supplier's contact information and we will confirm all shipment details. Once we have the actual time the cargo is ready, we will arrange the soonest shipping schedule. We'll keep you updated on any developments regarding the shipment. Our online tracking system will provide regular updates on the cargo status, including pickup, customs release, shipment, import customs release, and delivery to Amazon.

Q12: Why do you charge a duty deposit for an express shipment to Amazon?

For courier-express shipments, the express company (FedEx/DHL/UPS) handles customs clearance and duty collection. As Amazon is not the importer and won't pay the duty fee, the shipment must be arranged under DDP terms, requiring the duty to be paid in advance. The express company will collect the duty at origin to avoid delays at the destination. We collect the duty deposit in advance and settle the balance once the actual duty bill comes out, which can take 1-6 months for the express company to refund.

Q13: I am not located in the importing country. Is it necessary for me to have an EIN number in the U.S. and/or an EORI/VAT in Europe?

In many situations, Amazon sellers are not located in their destination countries. In order to import products, sellers are required to register for an EIN in the United States and an EORI in the UK and Europe.

Please click the following links to get more information about how to register.

United States EIN application link

United Kingdom EORI application link

Germany EORI application link

Additionally, if you plan to conduct long-term business in Europe, it is recommended that you register for VAT to avoid potential risks and protect your listing. Our UK and German partners can help you with the VAT registration process.Q14: Do I need another freight forwarder in the importing countri?

No! Luckylucky offers a one-stop cross-border logistics service for Amazon sellers, handling all of the exporting and importing countries' complex requirements through our sophisticated teams at both origin and destination. This allows our clients to focus on their products and listings' performance.

A POA (Power of Attorney) is all that's needed to authorize Luckylucky's destination broker to declare customs on behalf of the client. You are required to send the Power of Attorney (POA) for customs clearance authorization to our import broker 7-10 days prior to the arrival of the goods at the port. Please ensure timely payment of customs duties upon receipt of the import duty invoice to facilitate the smooth release of the goods and arrange for delivery.

Q15: How do I set the "Ship from address" in Amazon Seller Central? Should it be the manufacturer’s or the freight forwarder’s address? What's the name I need to show?

If you need a U.S. local address as the "Ship From" address, we can provide one for you. Otherwise, the "Shipping From" address and name is usually your manufacturer's address and name. Please ask your supplier to provide you with this information.

Q16: What is the correct information that Amazon needs to have on the outside of each carton? For example, the barcodes and other details?

For the master carton, Amazon requires only that the carton labels be affixed so that they can be scanned when being received. There is the same requirement for the product barcodes. Just make sure that Amazon can scan each product when an order is received.

However, due to the importing country's regulation, "Made in China" (or whatever country is pertinent) must be shown on the product itself and the packing box (shipping mark).

If "Made in China" is not shown properly on the product, the shipment might be rejected in import customs. Even if we can ask our import country’s office to assist with applying such a label to the product, the cost will be very high and the shipment will be delayed.Carton label & Pallet Label

1. Each box of goods should be affixed with 2-3 labels, and the labels should be prevented from falling off or being worn during transportation in the carton

2. The pallet labels of the same FBA ID are exactly the same, just stick to the center around the pallet (4 labels). The difference between the pallet label and the carton label is that the carton label is FBAID + serial number, and the ID under the barcode of the pallet label is only FBA ID, no serial number 001, 002, etc.Q17: Is the import duty I will need to pay included in this quote? Can you let me know how much duty I will have to pay?

Our freight quotation does not include import duty. We can provide an estimate of the duty tariff for your goods if you provide the HS code, material, and product pictures. However, the actual HS code classification and duty fee for a shipment are subject to official confirmation and duty bill from customs.

Q18: When do I need to arrange for the payment? What payment methods do you accept?

After the goods arrive at the warehouse, terminal, or airport, Luckylucky will issue a freight invoice (based on the actual measured weight and volume) and an deposit for import duties. Customers must pay all charges before shipment departure to avoid delays. Any additional costs or duty differences at the destination will be settled before final delivery.

Payment methods:

We accept payment by T/T. (Bank account in China, Hongkong, USA)

Western Union / PaypalQ19: What is the timeline difference for a shipment from destination to Amazon FBA if delivered by Amazon LTL, Courier express, or Luckylucky LTL?

Amazon LTL service (slowest speed, cheapest cost)

It takes 2-3 weeks to deliver a shipment to an Amazon FBA warehouse after Amazon's contract trucker has picked it up from the destination warehouse.

Courier-express service: (fastest speed, highest cost)

It takes 1-5 days to deliver a shipment to an Amazon FBA warehouse after courier express (FedEx/UPS/DHL) has picked it up from the destination warehouse.

Luckylucky LTL service (fast speed, balanced cost)

It takes 1-6 days to deliver a shipment to an Amazon FBA warehouse after Luckylucky's trucker has picked it up from the destination warehouse.Q20: Can I send my products to one fulfillment center? Can I nominate a delivery fulfillment center?

Yes, you can send your shipment to just one Amazon-assigned fulfillment center by participating in Amazon's " Inventory Placement Service". However, Amazon might charge you an extra fee for each unit of product to do so.

Only Amazon can determine to which fulfillment center a shipment is assigned.

If you have multiple products/ASINs or a single product with different sizes, they may direct it to different fulfillment centers.Q21: How can I assist with the import customs declaration when the shipment arrives at destination?

First of all, a client should be a qualified importer at destination, which requires a local EIN/EORI/Tax ID to be registered in advance. Then you need to issue a POA (Power of Attorney) to our import agents to authorize them to declare customs on your behalf.

Your supplier/exporter is also required to provide necessary documents, such as the Invoice and Packing List, a detailed description/photo/related certificate of product, and/or a certificate of origin (if needed).If you are just starting to sell on Amazon or prefer to choose lower-cost consolidated shipping services, we can provide you with an EIN (Employer Identification Number) and import agency services. Please note that using a non-self-provided EIN will not allow you to obtain original customs import documents or tax documents.

Q22: Why do I need to pay a deposit for a courier shipment? How do you pay the customs duty/tax for a courier shipment?

If a client is not a registered company in the import country, the courier-express company (DHL/FedEx/UPS...) accepts only a DDP shipment, as Amazon doesn't agree to act as the importer or pay the import duty/tax. This means that the import duty fee must be prepaid by the sender (Exporter). Normally, the client is requested to pay the DDP handling and import duty deposit before the shipment departs. After the courier-express company forwards the customs formal duty bill (1-6 months after shipment arrival), we will refund the duty deposit.

Q23: Who should print and affix the Amazon carton labels/pallet labels?

The most economical way is to request that the supplier/manufacturer print and affix the labels, as they are familiar with the product and, normally, they don't charge an extra service fee.

If the supplier/manufacturer is able to build pallets according to Amazon's requirements, they can print and stick the pallet labels as well. If the pallets will be built at destination, Luckylucky agents will take care of pallet labeling there.Additionally, if there is any special condition that requires replacement or removal of the previous labels after shipment departure, Luckylucky is still able to handle this at the client's request.

Q24: How do I arrange shipment when Amazon assigns more than one FBA warehouse in the U.S.A.?

When sellers create an Amazon shipment, they are always assigned more than one warehouse address. If it's a courier shipment, sellers need only to pay a higher unit shipping price, as the freight is normally cheaper if the weight of a shipment is bigger. However, if it's air freight or a sea freight shipment, sellers have to pay a fixed cost (documentation, declaration, handling) more than once.

Under the circumstances, we need to analyze the destination locations, considering the volume going to each address. Then we will determine which place should be the first stop, and then split the shipments after finishing the import declaration there.

However, if it's an urgent shipment, we need to balance the total freight difference and arrange direct shipping to each destination.Q25: Why is a customs inspection a possibility? Is there any way to avoid inspection or decrease the probability of an inspection?

Export or import inspections occur when they select your shipment randomly in their system. Sometimes, for certain categories of products, Customs requires more information, supporting documents, or even physical inspection of the products.

Nobody can avoid customs inspections. The only thing a client should do is to provide as much accurate information as possible when declaring customs. The client is also required to make sure that the manufacturer is able to provide any document when Customs needs it. Customs might need a certificate of origin, WiFi, USB, Bluetooth, CE, or FDA certification.

If you are not sure what kind of certification Customs might need, please provide the HS code of your product, and Luckylucky will help you confirm this with the destination broker teams.Q26: What is the import customs inspection category in the U.S.?

We list mainly the customs inspection category in the U.S. as follows:

1. X-ray Exam: no devanning, simple inspection, verify prohibited/hazardous articles.

Normally takes 1-2 days.

2. CET/Intensive Exam (contraband enforcement exam): Unload cargo and verify if the actual products match the declared information in customs.

Normally takes 5-6 days.

3. MET Exam: Devanning and counting the number of packages, check details of product, amount of goods, copyright, etc.

Normally takes 3-5days

4. Tailgate Exam: Inspect tail of container to see if there is any violation and determine further inspection.

Normally takes 3 days.Q27: What are the FBA packaging requirements?

Follow these general requirements when shipping units to Amazon fulfillment centers. Certain products have other specific requirements. Amazon may refuse, return, or repackage any product delivered to an Amazon fulfillment center with inadequate or non-compliant packaging at your expense, and you may also be subject to non-compliance fees.

Any FNSKU you use on a Unit must be unique and must correspond to one unique product. For example, each assortment type, such as size or color, will have a different FNSKU.

Each Unit must have an exterior scannable barcode or label (which includes a scannable barcode and the corresponding human-readable numbers) that is easily accessible.

Remove, cover, or render unscannable any existing scannable barcodes on the outside of shipping boxes. For example, cover existing barcodes with opaque tape or use a black felt-tip marker to render the barcode unscannable. This prevents the incorrect barcode from being accidentally scanned during the receiving process.

Q28: How should I package my shipments?

Follow these instructions to help shipments arrive undamaged and ready for intake to our fulfillment centers:

Use a rigid, six-sided box with flaps intact.

Use a single address label that has clear, complete delivery and return information.

Each box you include in the shipment must have its own FBA shipment label printed from your Shipping Queue.

Each pallet requires four labels, one on the top center of each side. Each box on the pallet also requires its own label.

When shipping multiple case-packs in a master carton, apply the unique shipping label on the master carton you are using for shipping inventory to Amazon fulfillment centers.

If you are reusing boxes, remove all old shipping labels or markings.

Wrap all items separately.

Use adequate packaging material.

Use strong tape designed for shipping.

Use two inches of cushioning between each of your items and the inside of the box.

After you pack your box, shake it gently. The contents should not move when shaken.Q29: What is DDC

DDC, destination delivery charge, can be considered as the THC (terminal handling charge). Usually, DDC will be quoted separately for U.S. routes

Q30: What is CFS warehouse fee

CFS generally refers to a warehouse for cargo consolidation or devanning. In most cases, CFS is a customs-bonded warehouse. The manifest of each shipment loaded into a container must be submitted to customs by CFS, the warehouse inbound, outbound and storage is supervised by customs. CFS warehouse fee including the unload fee apportioned in proportion to the goods and handling fee per shipment.

Q31: What is customs bond fee, single bond and annual bond.

Customs bond is a contractual agreement between the Importer of record, the Bond Surety Company and US Customs & Border Protection (CBP). Customs Bonds facilitate faster Customs clearance because they guarantee the CBP will be immediately paid if any additional import duties, taxes or fees need to be assessed. This allows the CBP to clear the shipment without having to wait for the Importer to submit payment. The CBP is paid by the Surety Company, then the Importer reimburses the Surety.

Customs Bonds are available as Single-Entry bonds, which cover individual shipments, or as Annual/Continuous Customs Bonds, which cover all shipments over a 12-month period. Customs Bonds are required by the CBP for all commercial imports valued at $2500 or more, even if a shipment is duty-free.

Customs Bond pricing depends on the bond value and type. Single-entry bonds are calculated based on the individual shipment, The calculation method of SINGLE BOND is US$65 within US$10,000 . If the value exceeds US$10,000 , US$6.5 will be levied for every US$1,000. The cost of purchasing annual bond is US$550/year plus US$50 as handling fee.

Q32: Why the cost of express delivery is lower than that of sea and air

The standard express service includes freight, delivery, import and export declaration. The freight paid to the courier company already includes the cost of all services. Choosing sea and air freight will incur a lot of fixed service fees such as customs declaration fees, bill of lading fees, pick-up and delivery fees, handling fees and etc. Unless the quantity of goods is large enough, because there are fixed expenses, the total door-to-door cost will be higher than that of express delivery. In practice, the total cost of air transportation within 200 kgs or sea freight within 1 cubic meter may not be economical by express delivery.

Q33: Why we have to pay 35% of invoice value as duty deposit for express delivery shipment

Normally the import duties for express cargo are paid by importers located in the importing country. Since you are not a company literally located in the importing country, the express company only accepts DDP, the import tariff prepaid in the origin. Since the import tariff bill of the express company takes 1 month or even up to 6 months to be returned to us, the express company will require us to pay 35% of the amount of the goods as a tariff deposit and US$35/shipment as DDP handling fee. This deposit will be used to offset the actual customs duties. Once we receive the customs bill for the goods, the deducted deposit balance will be returned to your company.

Usually, we recommend using PayPal to collect the duty deposit refund to avoid additional bank charges. If you choose wire transfer, you need to bear the wire transfer fee. If we don't receive tariff bill from express company for more than 6 months, we will return the tariff deposit to the customer first.

Although most import tariff rates are lower than 35%, the actual value of the goods recognized by the customs may be much higher than shipper's declared value, so the express company requires a deposit of 35% of the declared value of the goods.

In practice, express company only collect duty deposit for invoice value more than US$500.

Q34: Can we use your overseas warehousing service but ship the goods by ourself?

We prefer to accept warehousing order only for the shipments we handled the whole process from the beginning. As our overseas warehouse can hardly explain the source of the goods if there is any regulator inspection. As you may know government has increasing strict regulation for e-commerce import goods. We can‘t prove to the government that the goods are imported 100% no problem in compliance.

Q35: Can we use your importer of record agency service but ship the goods by ourself?

Sorry we could not provide importer of record agency service if the shipment is not handled by us. As we are unable to physically check the actual product or receive necessary proofs from the shipper. Unless the shipment is officially consigned to us by the shipper along with 100% legally presented documents/certifications.

Q36: Amazon appointment

Almost all Amazon-related sellers/logistics will know or know that Amazon's warehouse needs to make an appointment for delivery.

Not all types of warehousing require an appointment.SPD delivery does not require a separate appointment. The courier company has a daily appointment with Amazon. A separate appointment is required for truck deliveries.

Luckylucky's main business is shipping to Amazon door-to-door service. The appointment is a prerequisite before the truck is dispatched. Each LTL/FTL shipment is dispatched by trucks against case-by-case appointment in advance, and appointments are done by destination local LTL service provider sometimes.

Some trucks/agents will charge USD40 Amazon appointment fee as an operating fee to coordinate truck and cargo appointments.

Amazon's appointment needs to be made through carrier central, and the confirmed appointment will be sent by email with barcode and time. The carrier cannot make an appointment by phone/email, etc. Therefore, there is no public delivery contact in the Amazon warehouse.An Amazon appointment sample:

Hello, An appointment for LISF with ISA Id 68XXXXXX0 has been confirmed at Amazon.com's MEL1 Fulfillment Center for Tue 07/12/2022 14:30 AEST. Please make sure you have the appointment ID ready when you show up for the appointment.

Please ensure the driver has a printed copy or a soft copy of this email notification which includes the barcode. Thanks!

Appointment Summary:

Fulfillment Center: MEL1 Inbound Shipment Appointment (ISA) ID: 68XXXX0 Appointment Reference Code: MEL1-XX-6XXXO Arrival Date: Tue 07/12/2022 14:30 AEST Door: 17 Trailer Number: Shipments: ISD: 18XXXXXX90 PRO: SXXXD954-YMEL Pallet count: 3 Carton count: 67 POs: [4XXXXMOT, 7XXXXQM, 4XXXXL2U, 6XXXX5ET, 5XXXXS6T, 21XXXX7E, 4XXXXFUN, 1XXXXOHC, 53XXXX7Q, 5PXXXXVC] BOLs: [FBA1XXXXGGH6, FBA1XXXX45C1, FBA15XXXXXR, FBA15XXXXJJ, FBA1XXXXM8CH, FBA1XXXX06CZ, FBA1XXXXMCQ8, FBA15XXXXN74, FBA15DXXXX0C, FBA15D1XXXXP]

Vendor Name: Luckylucky International Supply Chain Co Ltd

Have a great day!

Amazon.com Transportation DepartmentQ37: How to choose the right delivery method to Amazon

Seller can either use LUCKYLUCKY arrange delivery or ask Amazon carrier pick-up goods from our overseas warehouses.

1. If you choose to be delivered by luckylucky, we will set appointment with amazon at the nearest delivery time for each shipment and provide POD after delivery is complete.

2. If you choose Amazon's self-collection, there are three ways to receive the goods by Amazon.a. SPD No appointment is required. This method can only be used by courier companies. The courier company has a regular appointment with Amazon. SPD does not need to go through carrier central again. Quantity: less then 15cartons, non-palletized goods.

b. LTL This method requires an appointment, labeling and palletizing according to specified requirements, and palletized goods are delivered by truck

c. FTL This method is to make an appointment and send the whole cabinet to the Amazon warehouse, and ask to refer to the Amazon documents. This method is rarely used, and it is likely to incur higher costs than demolition. In practice, we need to unload container in our warehouse and deliver they after labeling and palletizing after get appointment from Amazon.

Q38: How to guide customers to the information required to make an appointment

Normally, "FBA shipment ID" , "Reference ID" and "Ship to address" are required to make an appointment from carrier central,.

Usually, for goods delivered by sea or truck, we need to assist customers to find these information from the seller central.

The new background "send to Amazon is the green main interface, in the shipment summary section you can find the FBA shipment ID and Amzon reference ID" and "Ship to address". If the customer can't find it, please refer to the following Amazon "send to Amazon" step-by-step tutorial.https://sellercentral.amazon.com/help/hub/reference/GBJBZ65P2LHZM2DG

Q39: How to handle multiple FBA IDs

If there are multiple FBA IDs, but the goods are to the same address, we can arrange different FBA IDs in one shipment.Sellers are required to specify how many cartons belong to each FBA ID.

When making an appointment, different IDs of the same warehouse can make an appointment together in the background

Yes, just add a line. E.g.:

42CTNS FBAXXXXX Reference ID: XXXXXXX

50CTNS FBAXXXXX reference ID: XXXXXX

Ship to: ONT8Q40: How to deal with multiple assigned FBAs

If multiple IDs correspond to different FBA warehouses

① It is recommended that customers use Amazon inventory replacement service to merge warehouses.

② It is recommended that customers use the 3rd-party warehouse + Amazon pickup mode (US)

It is not recommended for customers to send shipments directly to multiple warehouses,Because: 1. Multiple goods are shipped separately leads to more fix cost expense.

2. Long transit time might cause the label to expire on the road

Q41: What is BOL when deliver to FBA.

BOL number: BOL that seller mentioned refers to the documents when truck deliver to the Amazon warehouse.

This what logistics company usually call delivery order or POD.

Customers often associate Amazon's BOL (local delivery to FBA at destination) with Ocean/Air Bill of Lading(port of loading-port of discharge), requires logistics company show Reference ID on the Ocean/Air Bill of Lading, h/ever, this ID is not required to be displayed on the Ocean/Air Bill of Lading.Q42: Why there is no POD after delivery.

Amazon no longer offers stamped PODs after the pandemic.

Amazon U.S. uses Amazon's seller central appointment record as POD proof.

Amazon Singapore adopts electronic file e-POD

Amazon Australia uses a handwritten signature or electronic signatureQ43: How to avoid labels that have expired when you deliver to Amazon

Due to the congestion in the port of the importing country, the entire transportation time will last for 30-60 days. If the label is created too early, it may have expired when it is delivered to Amazon, and the receiving warehouse will not be able to scan the label.

If you are factory labelling, try to label only before delivery goods to your forwarder at the origin country.

Please try to let the logistics company choose the consolidation service directly to the nearest destination of the warehouse (applicable for some cities such as Dallas, NewYork, Houston, Miami, Atlanta, Chicago)Q44: What is the process for getting customs clearance for my shipment?

The process for customs clearance involves submitting the necessary documentation, paying any applicable duties and taxes, and having your shipment inspected by customs officials. You can either handle this process yourself or hire a customs broker to assist you.

Q45: Can you help me with obtaining the necessary import licenses and permits?

Depending on the type of product you are importing, you may need to obtain certain import licenses and permits. It is best to check with the relevant government agency to determine what is required. If you need assistance with the process, you can hire a customs broker or freight forwarder.

Q46: How can I ensure that my shipment complies with local regulations and standards?

To ensure compliance with local regulations and standards, businesses should work with a knowledgeable and experienced logistics provider. They can help businesses navigate complex customs regulations, product requirements, and documentation requirements. Additionally, businesses should thoroughly research the regulations and standards in the destination country before shipping their goods.

Q47: How can I minimize the risk of damage or loss during transit?

To minimize the risk of damage or loss during transit, businesses should use appropriate packaging materials and methods. They should also work with carriers who have a good track record of safe and reliable transportation. Additionally, businesses should consider purchasing insurance to protect against potential losses.

Q48: What is the difference between a bill of lading and a waybill, and when should I use each one?

A bill of lading is a legal document that serves as a contract between the shipper and the carrier, outlining the details of the shipment, including the goods being transported, the destination, and the terms of the agreement. A waybill, on the other hand, is a document that accompanies the shipment and provides information about the goods being transported, but does not serve as a legal contract. Waybills are typically used for air and courier shipments, while bills of lading are used for ocean and some land-based shipments.

Q49: We have 3 different suppliers. Does it mean that we need to make 3 payments for customs clearance?

If the goods from your three suppliers are destined for different locations, then the export local charges for each destination need to be

calculated separately. However, if your goods are headed to the same destination, we can consolidate shipments to negotiate more competitive freight and export charges.

The possibility of combining customs clearance depends on the trade terms; for FOB terms, suppliers usually handle export clearance themselves. In the case of EXW terms, we can consolidate customs clearance for the goods of three clients. In summary, when purchasing goods from multiple suppliers, using EXW terms makes it easier for your shipping agent to consolidate shipments and declarations.

Q50: Why is the amount on the invoice different from the quoted price?

The invoice amount may differ from the quoted price due to changes in the shipped quantity compared to the inquired quantity. The final freight calculation is based on the actual shipped quantity, which can affect unit prices. Additionally, frequent fluctuations in the shipping market may impact costs. Quotations have validity periods, and if goods are shipped after this period, costs need reconfirmation.

Q51: Does the quote cover pick-up service from the factory, and what steps should be taken for pick-up service if the Incoterm is FOB?

On our real-time FBA shipping query webpage, you can enter the FBA CODE assigned by Amazon, the city of origin, total gross weight, volume, and value of the goods. Our system will display different shipping options. If you wish to receive a quote from our customer service, please provide the Amazon-assigned FBA CODE, supplier's address, product name, total gross weight, volume, and value of goods.

Q52: How to Register on Your Company's Website:

Click the "Register" button in the top right corner of the webpage. Enter the company name, your name, phone number, and email. After clicking "Send Verification Code," check your entered email for the received verification code. Input the verification code, set a password, and proceed to successfully complete the registration process.

Q53: What do I need to do after the quote is accepted and the order is confirmed?

After you confirm the order, please provide us with the contact information of the shipper and notify the shipper that Luckylucky is your designated logistics provider. We will contact the shipper to issue a formal booking instruction. We will handle all processes for both export and import, and provide you with updates on key milestones, including cargo readiness, pickup, customs clearance completion, loading, arrival at the destination port, import clearance, appointment for delivery, and completion of delivery.

Once the goods are loaded onto the ship, we will send you the invoice for charges, and upon the arrival of the goods, we will send you a confirmation for import duties. Overall, after you confirm the shipping arrangement, you only need to wait for us to update you on each milestone until the goods are shelved on Amazon.

Q54: After confirming an order, how can I track the progress of my shipment:

You can log in and navigate to the "Shipment" section to view your consignment list. You will find an overview, current status, and estimated delivery time for each shipment. Clicking on any shipment allows you to access detailed information. The key status updates for the major milestones of the shipment will be displayed on the right side of the webpage, with blue indicating completed statuses and gray indicating anticipated statuses.

Additionally, you can click on "Description of Goods" to view specific details about the goods and access "Shipping Documents" to review documents related to shipping rates, orders, invoices, and other relevant information. Once all relevant charges associated with the shipment are confirmed, the expense invoice will be displayed as viewable and downloadable. You can review the expense information at that point.

Q55: How do I choose from the different shipping options displayed in the query results:

You can log in and navigate to the "Shipment" section to view your consignment list. You will find an overview, current status, and estimated delivery time for each shipment. Clicking on any shipment allows you to access detailed information. The key status updates for the major milestones of the shipment will be displayed on the right side of the webpage, with blue indicating completed statuses and gray indicating anticipated statuses.

Additionally, you can click on "Description of Goods" to view specific details about the goods and access "Shipping Documents" to review documents related to shipping rates, orders, invoices, and other relevant information. Once all relevant charges associated with the shipment are confirmed, the expense invoice will be displayed as viewable and downloadable. You can review the expense information at that point.

Q56: How can I know if my product needs fumigation service:

A fumigation certificate, frequently referred to as a pest-control certificate, is a document used to confirm that all wooden packing materials in a cargo shipment have been fumigated. Materials that require sterilization or fumigation before international shipping are raw wood items such as wood pallets or crates, wool, dunnages, and drums. However, wood-derived products like cardboards, particleboard (chipboard), and other man-made materials are exempt when importing in some countries. A fumigation certificate is compulsory when shipping international or ocean freight cargo. Failure to comply with these measures risks your cargo not being sent, liquidated, or quarantined upon arrival in other ports.

Q57: This is my first shipment. Can I ask if you usually obtain all necessary documents from my manufacturer:

Typically, in addition to export declaration documents, the shipper is required to provide the invoice, packing list, and contract for import customs clearance. Depending on the nature of the goods, additional documents such as MSDS (for electrical/chemical products), fumigation certificate (for items with wooden packaging), FDA certificate (for food, pharmaceuticals, or products in contact with the human body), and various other certificates may be necessary. As your agent, we will usually liaise with the shipper to obtain all the required documents for the various stages of transportation, import, and customs clearance.

Q58: Once I book with you, how long will it take for my package to arrive at FBA:

The time required to deliver to FBA warehouses generally depends on several factors: the readiness of goods by the exporter, transportation time, import clearance time, handling time at the import port and deconsolidation warehouse, and Amazon's scheduled receiving time. For most express and air freight shipments, the overall transit time from receiving the goods to delivering to the FBA warehouse typically ranges from 3 to 10 days. For sea freight shipments, the estimated transit time is approximately 10-20 days from China to Japan and Southeast Asian countries, 18-30 days to the Middle East and Australia, and 28-40 days to Europe and North America (excluding expedited services to North America). You can contact your dedicated customer service representative to inquire about the estimated delivery time.

Q59: For shipping labels, I have already informed the supplier to put the label. However, there may be a chance that they will make a mistake or not do it correctly. So it will be good if your team can check all cartons and see if all is okay before sending it:

Typically, we recommend having the manufacturer apply the labels to the goods and cartons because, based on experience, this method is the most cost-effective and less prone to errors. The manufacturer is the most familiar with the goods. As warehouses handle a variety of

goods entering and leaving daily, conducting additional checks and labeling is a time- consuming and costly process for them. Unless the factory consistently makes labeling errors and the goods and packing list information is exceptionally clear, the warehouse may assist in checking and labeling. You can confirm with customer service the time and cost associated with labeling or checking labels at different warehouses.

Q60: After creating shipping plan, Amazon changed the destination address, how does it affect the price? By a lot? Or small amount:

If Amazon changes the destination after you create the shipping plan, it typically results in a significant cost increase. Firstly, due to the address change, all carton labels need to be reprinted and reapplied. Additionally, if the goods have already left the factory, there are costs associated with transferring the goods to a facility where relabeling can be performed. If the goods have been shipped or customs clearance is complete, relabeling can only occur at the destination country's warehouse after the goods arrive. Furthermore, if Amazon modifies the delivery address, you will need to reconfirm the transportationcosts with our customer service. The manufacturer advised that you are asking for my shipping mark on each carton.

Q61: Do I need to engage any other freight forwarders for handling import matters at the destination port:

No! Luckylucky offers a one-stop cross-border logistics service for Amazon sellers, handling all of the exporting and importing countries' complex requirements through our sophisticated teams at both origin and destination. This allows our clients to focus on their products and listings' performance. A POA (Power of Attorney) is all that's needed to authorize Luckylucky's destination broker to declare customs on behalf of the client.

Q62: How can I ensure that my shipment complies with local regulations and standards?

To ensure compliance with local regulations and standards, businesses should work with a knowledgeable and experienced logistics provider. They can help businesses navigate complex customs regulations, product requirements, and documentation requirements. Additionally, businesses should thoroughly research the regulations and standards in the destination country before shipping their goods.

Q63: When our goods need to be replenished from your 3PL warehouse to Amazon FBA, what are the available methods?

A: Seller can either use LUCKYLUCKY arrange delivery or ask Amazon carrier pick-up goods from our overseas warehouses.

If you choose to be delivered byhttps://static-assets.sxlcdn.com/images/editor2/draft-editor/fontSize.svg luckylucky, we will set appointment with amazon at the nearest delivery time for each shipment and provide POD after delivery is complete. We typically choose between LTL (Less Than Truckload) or Courier Express services based on the volume of goods and the delivery address.

If you choose Amazon's self-collection, there are three ways to receive the goods by Amazon.

a. SPD No appointment is required. This method can only be used by courier companies. The courier company has a regular appointment with Amazon. SPD does not need to go through carrier central again. Quantity: less then 15cartons, non-palletized goods.

b. LTL This method requires an appointment, labeling and palletizing according to specified requirements, and palletized goods are delivered by truck. c. FTL This method is to make an appointment and send the whole cabinet to the Amazon warehouse, and ask to refer to the Amazon documents. This method is rarely used, and it is likely to incur higher costs than demolition. In practice, we need to unload container in our warehouse and deliver theyafter labeling andpalletizing after get appointment from Amazon.

Q64: How can I minimize the risk of damage or loss during transit?

A: Seller can either use LUCKYLUCKY arrange delivery or ask Amazon carrier pick-up goods from our overseas warehouses.

If you choose to be delivered by luckylucky, we will set appointment with amazon at the nearest delivery time for each shipment and provide POD after delivery is complete. We typically choose between LTL (Less Than Truckload) or Courier Express services based on the volume of goods and the delivery address.

If you choose Amazon's self-collection, there are three ways to receive the goods by Amazon.

a. SPD No appointment is required. This method can only be used by courier companies. The courier company has a regular appointment with Amazon. SPD does not need to go through carrier central again. Quantity: less then 15cartons, non-palletized goods.

b. LTL This method requires an appointment, labeling and palletizing according to specified requirements, and palletized goods are delivered by truck. c. FTL This method is to make an appointment and send the whole cabinet to the Amazon warehouse, and ask to refer to the Amazon documents. This method is rarely used, and it is likely to incur higher costs than demolition. In practice, we need to unload container in our warehouse and deliver theyafter labeling andpalletizing after get appointment from Amazon.

Q65: How can I minimize the risk of damage or loss during transit?

To minimize the risk of damage or loss during transit, businesses should use appropriate packaging materials and methods. They should also work with carriers who have a good track record of safe and reliable transportation. Additionally, businesses should consider purchasing insurance to protect against potential losses. Follow specific requirements when shipping units to Amazon fulfillment centers.

Q66: What is a certificate of origin, and when is it needed for international shipments?

A certificate of origin is a document that confirms where goods come from. It's needed for international shipments to show the source country of the products. Customs authorities may require it to determine tariffs and ensure compliance with trade agreements.

Q67: What is the difference between a bill of lading and a waybill, and when should I use each one? How about telex released bill of lading?

A bill of lading is a detailed receipt for shipped goods and can be transferred to others, while a waybill is a simpler document that confirms shipment but isn't transferable. Use a bill of lading for ocean or multimodal transport and a waybill for simpler, direct shipments like air freight or courier services. Telex release (or electronic release) is a type of bill of lading where the shipping company allows the release of goods without requiring the physical presentation of the original document. It's often used to expedite cargo release at the destination.

Q68: Can you explain the concept of dimensional weight and how it impacts shipping costs?

Dimensional weight, also known as volumetric weight or DIM weight, is a pricing technique used by shipping carriers to account for the space a package occupies in relation to its actual weight. It is particularly relevant when shipping lightweight, large-sized packages, ensuring fair pricing for carriers.

Q69: What are the advantages of using a third-party logistics provider (3PL) for shipping and warehousing?

Utilizing a 3PL warehouse offers storage cost advantages, flexibility in overcoming Amazon FBA storage constraints, and swift inventory replenishment. During off-peak seasons, lower transportation costs to the destination country can be chosen. Using a 3PL in the origin country provides lower storage costs, central processing, and storage of goods.

Q70: Why do I need to confirm DDU or DDP for courier express shipping even with FOB/EXW incoterms?

DDU or DDP specifically pertains to customs duty payment for express services. For express shipments, pre-paid destination port duty service is offered to avoid additional costs at the destination port, especially when importers lack resources for customs declaration.

Q71: What are the chargeable weights in courier and air freight shipping?

The chargeable quantity for express delivery is calculated based on chargeable weight, considering volume and actual weight. For air freight, the chargeable quantity is based on volume and actual weight. LCL goods' chargeable quantity depends on base port or transshipment, calculated using gross weight and volume.

Q72: What kind of document do I need to present if the cargo contains a battery?

Certification for Safe Transport of Chemical Goods and MSDS report issued by Shanghai Research Institute of Chemical Industry Testing Co., Ltd. is needed for shipping companies/airlines when cargo contains a battery.

Q73: Can you explain FBA Express Premium, FBA Shuttle DDU, and FBA Consolidation DDP services?

What is FBA Express Premium Service

FBA Express Premium is an advanced service tailored for established sellers with their own companies in the importing country. With 4-6 weekly sailings, it seamlessly aligns with your goods' preparedness, ensuring flexible and timely shipments. Individual customs clearance in the destination port, along with separate appointments and deliveries, minimizes wait times for goods delivery. After arrival, goods can be available for sell as early as the next day. We provide comprehensive export and import records, tax documents, making it the preferred 100% compliant and sustainable supply chain solution for sellers operating at scale.

What is FBA Shuttle DDU service

FBA Shuttle DDU is an economically flexible service tailored for small and medium-sized sellers. It efficiently consolidates the goods of multiple sellers, combines them into one shipment, and thereby reduces the costs associated with import and export processes. The last-mile delivery is executed through Less Than Truckload (LTL) or courier services, ensuring swift distribution to various destinations. This transportation method eliminates the necessity for sellers to register a company in the importing country, as all goods undergo customs clearance under the name of a single consignee. Customs declarations are made based on the actual values of the goods, and detailed tax invoices and import documents for each individual shipment are provided.

What is FBA Consolidation DDP service

FBA Consolidation DDP is a flexible shipping service designed for small-scale sellers, encompassing all expenses in both the import and export countries, including tariffs. The service is billed based on kilograms, with varying minimum billing weights depending on the destination. It is particularly suitable for new sellers conducting tests in new markets or categories and facilitating flexible restocking. Due to the consolidated declaration process for goods from multiple sellers, there is a potential risk of delays if any of the other sellers' goods undergo inspection, affecting the clearance of the entire batch. It is imperative that this service relies on 100% accurate declaration of information and values for the goods.

Q74: How is the chargeable volume calculated, and what is considered in determining the chargeable volume?

The chargeable volume is calculated by dividing the gross weight (KGS) by 363. The greater value between the calculated volume and the actual volume will be considered in determining the chargeable volume

Q75: Who determines the HS Code classification and final tariff imposed by the importing country's customs, and what responsibilities does the client have during this process?

The customs authorities determine the HS Code classification and final tariff imposed by the importing country's customs. We can assist in conveying any objections or discrepancies regarding the applicable HS CODE and tariff rates. However, any demurrage fees incurred at the port or related to containers during this process will be your responsibility for payment.

Q76: What documents does the service, operating under a consolidated declaration model, provide to customers, and are there additional fees for individual customs clearance?

This service, operating under a consolidated declaration model, does not provide customers with export or import documents under their own names. If exporters require individual customs clearance for the purpose of applying for export tax refunds, additional export customs clearance fees will be incurred. In such cases, please select the "Separate Export" option.

Q77: What services are included in your end-to-end solutions?

In essence, our comprehensive end-to-end service spans the entirety of the supply chain process, commencing with liaising with the shipper and concluding with the delivery to the Amazon FBA warehouse. This encompassing service entails export booking, customs clearance, delivery management, packaging, document validation, import customs clearance, import agency representation, import appointment scheduling, goods unpacking, and the entire logistics delivery process.

Q78: What countries does your online quotation service cover?

Our online real-time query service covers the following countries: China to Amazon in the United States, Canada, Mexico, Japan, the United Kingdom, Germany, France, Spain, Italy, Poland, the United Arab Emirates, Saudi Arabia, Australia, and Singapore. You can input the FBA CODE for your destination, choose the port of origin, enter the gross weight, volume, and value of the goods on our website. The website will automatically display different shipping services and select the most economical option. The fastest departure and arrival services will also be indicated. If the service you need is not available in our online quotation system, please send the information about your goods, pickup and delivery addresses, and your trade terms (FOB or EXW) to inquiry@lliff.com. Our customer service will respond to you within half a working day.

Q79: How can I get a shipping quote?

Option 1: Online Instant Quotation

You can easily get instant shipping to Amazon quote in our website: https://www.scaas.com for goods exported from China. Current our services cover the route from China to following countries: Amazon United States, Canada, Mexico, Japan, the United Kingdom, Germany, France, Spain, Italy, Poland, the United Arab Emirates, Saudi Arabia, Australia, and Singapore. Just input the FBA CODE for your destination, choose the port of origin, enter the gross weight, volume, and value of the goods on our website. The website will automatically display different shipping services and select the most economical option. The fastest departure and arrival services will also be indicated.

Option 2: Customer Service quotes rate case by case

If the service you need is not available in our online quotation system, please send the information about your goods, pickup and delivery addresses, and your trade terms (FOB or EXW) to inquiry@lliff.com. Our customer service will respond to you within half a working day.

Q80: How can I inquire about warehousing quotes?

You can check our GLOBAL STOCKING webpage at https://www.lliff.com/fbashuttle for quotes on China and Amazon major overseas FBA warehouses.

Q81: Which countries can currently provide overseas warehouse services, and what services are included in your overseas warehouse services?

We offer overseas warehouse services in the United States, Australia, the United Kingdom, Singapore, and China. You can choose local storage of goods overseas, replenish quickly to local Amazon FBA warehouses, overcome customer service capacity limitations, navigate fluctuations in ocean shipping, reduce FBA warehousing costs, and enhance flexibility in multi-country inventory retrieval. We can also transfer your unsold foreign goods to other Amazon markets. Our overseas warehouse can provide global inventory allocation services such as labeling, box replacement, and repackaging for shipping to major Amazon countries. For overseas warehouse replenishment, you can choose services such as LTL, SPD, and more.

Q82: What features does your warehousing service in China have?

Our warehousing service in China offers customers a lower-cost and more flexible option. You can place orders with multiple suppliers and send goods to our consolidation warehouse in China at any time. Enjoy lower warehousing prices and use our online real-time quoting system to calculate the cost of replenishing to multiple countries at any time. Your FBA shipping orders can be quickly and efficiently fulfilled.

Q83: what's your warehousing quote if i store inventory in your warehouse in Australia

Warehouse Inbound: US$3/Carton Minimum US$10 or US$8/Pallet

Segregation & Move to Storage: US$0.5/Carton Unpalletized

Labeling Fee: US$1.75/Label

Warehouse Outbound:

Outbound Processing US$5/Shipment

Outbound Fee US$3/Carton or US$5/Pallet

Packing Material * if needed: US$3/Carton + Buy carton cost or US$30/Pallet

Storage Charge: US$1.5/CBM/Day 1-60days US$2/CBM/Day 61-120days US$2.5/CBM/Day >120days

Inspection of individual carton: US$2/Carton US$0.3/Piece(if needed)

Q84: what's your warehousing quote if i store inventory in your warehouse in United States (U.S.A.)

Warehouse Inbound: US$3.5/Carton 1-50 cartons US$3/Carton 51-100 cartons US$2.75/Carton >100 cartons

US$15/Pallet

Segregation & Move to Storage: US$1.5/SKU Unpalletized or US$15/Pallet Palletized

Labeling Fee: US$1.5/Label

Warehouse Outbound:

Outbound Processing US$5/Shipment

Outbound Fee US$3/Carton or US$12/Pallet

Packing Material * if needed: US$5/Carton + Buy carton cost or US$25/Pallet

Storage Charge: US$8/CBM/Week 1-60days US$16/CBM/Week 61-120days US$18/CBM/Week >120days

Inspection of individual carton: US$3/Carton US$0.45/Piece(if needed)

Q85: what's your warehousing quote if i store inventory in your warehouse in Singapore

Warehouse Inbound: US$4/Carton US$7/Pallet

Segregation & Move to Storage: US$0.5/Carton Unpalletized

Labeling Fee: US$1.8/Label

Warehouse Outbound:

Outbound Processing US$5/Shipment

Outbound Fee US$4/Carton or US$8/Pallet

Packing Material * if needed: US$3/Carton + Buy carton cost or US$30/Pallet

Storage Charge: US$15/Pallet/Week 1-60days US$20/Pallet/Week 61-120days US$25/Pallet/Week >120days

Inspection of individual carton: US$2/Carton US$0.3/Piece(if needed)

Q86: what's your warehousing quote if i store inventory in your warehouse in China

Warehouse Inbound: Free

Segregation & Move to Storage: US$2.5/CBM

Labeling Fee: US$0.5/Label

Warehouse Outbound:

Outbound Fee US$2.5/Carton or US$12/Pallet

Packing Material * if needed: US$0.8/Carton + Buy carton cost or US$22/Pallet

Storage Charge: US$0.45/CBM/Day

Inspection of individual carton: US$0.5/Carton US$0.25/Piece(if needed)

What are the seven components of FSVP?

Today’s global marketplace has driven more companies to look abroad for suppliers. And while sourcing internationally has always been challenging, FSMA’s Foreign Supplier Verification Program (FSVP) doesn’t make it any easier. The FSVP rule shifts responsibility for ensuring the safety of imported food products from the government to companies. And the FDA holds importers accountable for ensuring the food entering the United States is up to the agency’s standards.

So, we’ve outlined seven recommendations that help businesses subject to the FSVP rule succeed.

Review supplier compliance status. The FSVP rule expects U.S. importers to review the compliance status and history of foreign suppliers to pinpoint potential risks. As a result, this assessment should include any “FDA warning letters, import alerts, and requirements for certification issued by the FDA under section 801(q) of the Food, Drug, and Cosmetic Act (FD&C Act).”

Conduct a hazard analysis. Importers must investigate any hazards associated with everything they import, including the likelihood and potential severity of each hazard. Frequently, foreign suppliers have already performed a hazard analysis. But it’s vital not to take this at face value. U.S. importers must scrutinize this documentation and compare it with in-house hazard analysis to ensure its sufficient. If a supplier hasn’t performed a hazard analysis, the importer must shoulder the responsibility of examining the foreign supplier’s operations and identifying any hazards that require control. Product verification isn’t necessary if the review fails to uncover any risks. However, the U.S. importer should keep a record of the hazard analysis on file.

Verify suppliers. Through verification activities, importers must provide sufficient assurances that potential risks are actively identified, controlled, and monitored. Verification activities can include onsite audits, periodic sampling, and reviewing foreign supplier documentation. Importers can conduct onsite audits or contract a third-party auditor to examine a foreign supplier’s operations. But onsite audits aren’t required unless there’s a good chance a hazard could cause serious adverse health consequences or death, according to the Code of Federal Regulations (CFR) Title 21. If the importer relies on product testing and sampling for verification, they must maintain detailed records on each test’s process and outcome.

Take corrective actions as needed. Any complaint an importer receives about the food they import needs an investigation to uncover the cause and the appropriate corrective action. Further verification activities might determine a supplier isn’t storing products at the required temperature, qualified facilities for field workers, for example. And each instance requires a unique and appropriate corrective action to demonstrate that remedies are specific to each situation, supplier, and product.

Periodic reassessment of FSVP. Every three years, importers must reassess their FSVPs. The exception is if the importer is aware of new information about potential hazards. In which case, the reassessment needs to occur sooner in response to the discovery. And if the review finds an imported product doesn’t meet FSVP requirements, the importer must take corrective action. Steps might include not working with the supplier until they address the identified hazards or electing to update their FSVP plan to ensure they vet suppliers more thoroughly in the future.

Importer identification at entry. The FSVP rule requires importers to provide a legal business name, electronic mailing address, and unique facility identifier (UFI) for all food products entering the U.S. The Data Universal Numbering System (DUNS) number, assigned and maintained by Dun & Bradstreet, is free and the only FDA-proved UFI.

Recordkeeping. The FDA is taking more steps to increase the number of records kept. Under this rule, the FDA requires importers to maintain records related to compliance status, foreign supplier verification activities, hazard analyses, investigations, corrective actions, and FSVP reassessments.

A preference for digital records

Although the FDA hasn’t requested it for other rules, there are clear indications it prefers digital records for FSVP compliance. This preference is evident in two ways:

Electronic access to records. The importer must provide electronic access to records immediately upon review. And if the FDA requests documents, they’ll visit a facility and make or receive copies. However, if you’re importing products from another country, the FDA doesn’t want to wait.

Records can’t deteriorate. Additionally, companies must maintain all records in a way that’s not subject to deterioration and easily interpreted as digital.

Incoterms 2020 Rules